Cryptocurrency has continuously gained momentum in Nigeria over the years; from students and side hustlers to corporate workers, everyone is searching for new (and better) ways to invest their income without losing out to the ever-changing government and law, and for many individuals, Cryptocurrency has come to resolve those concerns.

While the opportunity to invest your income in Cryptocurrency is real, like every other form of investing, it comes with its own risks.

A major risk the financial industry has always faced is scams, but with the rise of cryptocurrency, these scams have become more sophisticated, faster-moving, and far-reaching. It’s no longer just about losing money; it’s about breaking the trust in an ecosystem that’s still building its credibility in countries like Nigeria.

Crypto scams are getting smarter by the day, often dressed up as “investment opportunities” or “community-backed tokens.” If you’re not paying close attention, it’s easy to get caught off guard and lose your money faster than you earned it.

To help you stay ahead, here are five major red flags to watch out for so you can spot a crypto scam and protect your funds like a pro.

1. Promises of Guaranteed Profits or Zero Risk

Let’s be honest, we’ve seen this movie before.

MMM promised 30% monthly returns and paid out for some people, until the whole thing collapsed. Then came Ultimate Cycler, Swiss Golden, and more recently, CBEX.

CBEX lured people in with promises of “daily earnings” of up to ₦25,000 just for signing up and “investing”. They had it all: a sleek website, polished testimonials, active Telegram groups, and WhatsApp broadcasts that sounded legitimate. But once enough people joined, the platform vanished and so did everyone’s money.

X was flooded with stories of individuals losing over ₦2 million to CBEX after trusting a friend’s ‘referral’.

No real crypto platform or trader guarantees fixed profits, especially not daily returns. The crypto market is volatile. Profits and losses are part of the process.

If you ever see: “ROI in 3 days”, “Zero risk, guaranteed income”, or “Earn passively every day without trading”, take a step back because you’re likely looking at a scam.

2. No White Paper, Roadmap, or Real Use Case

Every real cryptocurrency project is built on purpose. It’s created to solve a problem, serve a need, or improve how something works, and this should be clearly explained in a whitepaper.

But most scam tokens skip that part entirely.

In 2022, a trending coin on Instagram used heavy influencer shoutouts, sleek design, and paid ads to gain attention. But it had no whitepaper, no product, no team info, and no real use case. After weeks of aggressive promotion and collecting people’s funds, the page disappeared. Coin holders were left stuck, unable to trade or withdraw.

Before you invest in any project, ask:

- What problem does this token solve?

- Can I see its whitepaper?

- Who are the people behind it?

- Is there a roadmap or product I can try?

If you can’t answer those questions confidently, you might be dealing with a red flag.

3. Unsolicited DMs from “Admins” or “Traders”

Scammers love pretending to be someone they’re not.

You join a Telegram group or follow a crypto page on Instagram, and shortly after, you get a DM from someone calling themselves a “trading expert” or “platform admin.” They offer to “help you grow your portfolio” or “activate your bonus,” asking for your wallet details, OTP, or a small payment to unlock access.

It might feel helpful at first, but it’s almost always a trap.

No credible platform or project will:

- Message you first in DMs

- Ask for your wallet seed phrase

- Request OTPs or passwords

- Ask you to send crypto for “activation”

Always verify messages through official channels. If someone reaches out to you first with offers involving money or access, it’s safer to block and report.

4. Hype Without Product

Scam tokens are experts at creating noise.

They hire influencers, launch giveaways, flood social media with hashtags, and use flashy visuals to grab attention. But when you dig deeper, there’s no real value:

- No product

- No active development

- No working platform

- No way to trade, use, or apply the token

It’s all buzz, no backbone.

Real projects focus on what they’re building, not just how loud they can shout. Before you invest, check:

- Is there a demo or prototype?

- Are people using the platform?

- Can you track development updates or user feedback?

If it’s all surface and no substance, don’t walk into a trap.

5. No Presence on Credible Platforms

This is one of the fastest ways to run a credibility check.

Before investing in a token or platform:

- Search for it on CoinMarketCap or CoinGecko

- Look for mentions on Reddit, Twitter, or trusted crypto news sites

- Read what users and communities are saying (both good and bad)

If the only content you can find is from the project itself and it’s all positive or promotional, that’s a red flag.

Scam tokens rarely make it to credible listings or trusted exchanges. They stay hidden, operate short-term, and rely on fake buzz to pull people in.

Visibility equals accountability. If a project avoids visibility, you should wonder why.

Final Thoughts

As crypto gains traction in Nigeria, so do the tactics of scammers and they’re only getting more creative.

But here’s the thing: if you take a moment to slow down and look closely, the red flags are usually right there: promises of outrageous profits, no whitepaper, shady DMs from “admins,” lots of hype but no real info, or zero online visibility, are all signs to walk away.

Before you invest, ask the tough questions. Don’t just move with the crowd.

And remember: if it sounds too good to be true, it probably is.

Trade Smart, Not Just Fast.

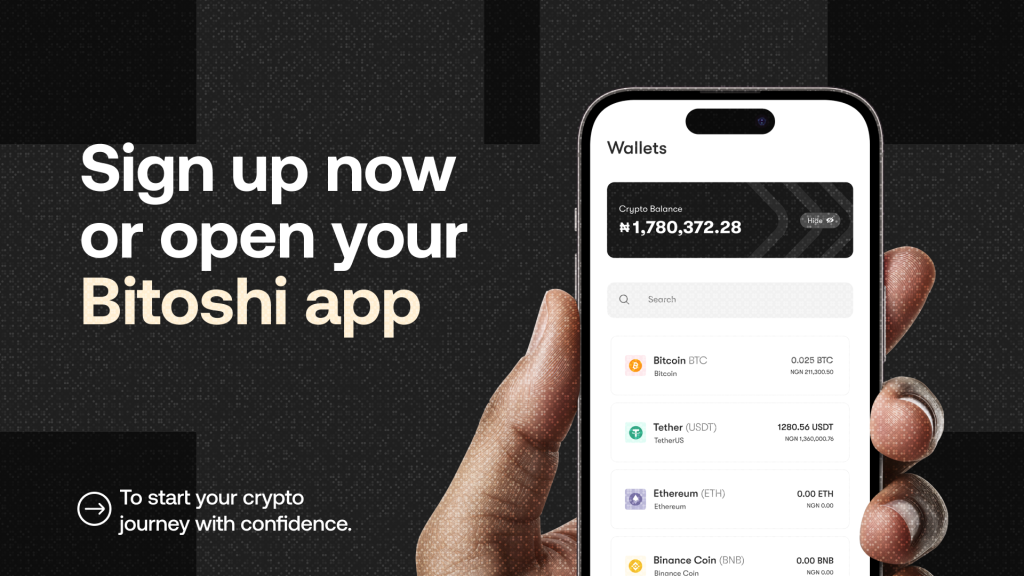

Join the Bitoshi community, where real people learn, grow, and trade safely, together. Transparent. Beginner-friendly. No hype, just real value!

Sign up now or open your Bitoshi app to start your crypto journey with confidence.